The vast majority of homeowners have no idea what ordinance and law coverage is. Nor do they care. And truth be told, ordinance and law discussions tend to have the same effect as a tranquilizer dart. But hang in there. We’ll do our best to make this bearable. And in the end, you’ll be glad for the extra knowledge.

Standard Ordinance and Law Coverage

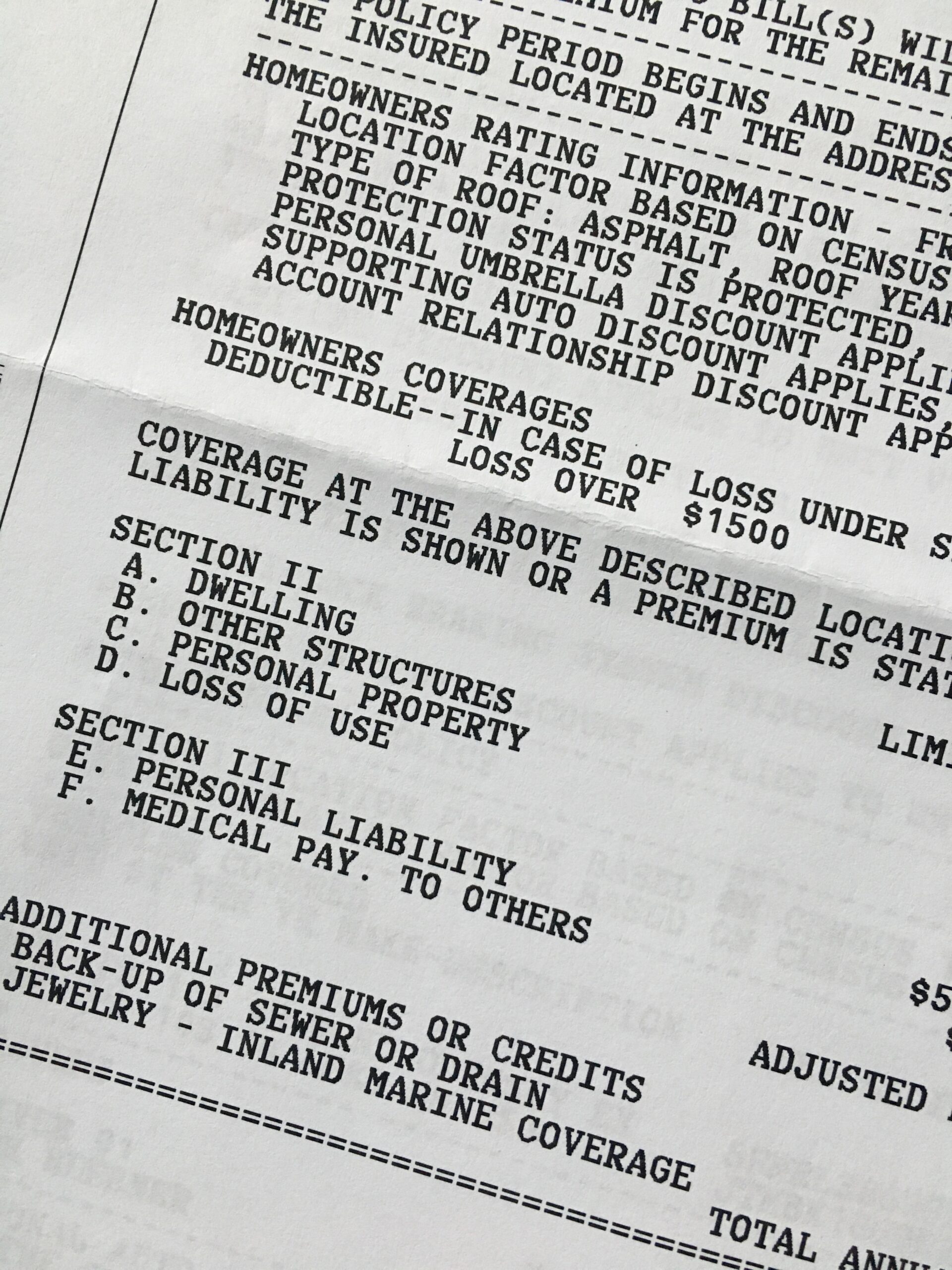

Insurance agents write homeowners policies based on the estimated cost to repair or rebuild at that particular moment in time. The issue is that while a homeowners policy stays the same, the costs associated with repairing or rebuilding change. These costs rarely decrease. They typically increase based on any number of factors, including stricter laws and building codes.

Where the Standard Falls Short

That extra 10% coverage for costs associated with ordinance and law may seem fine, but there are many times when it falls short. And the older the home, the more susceptible it is to code upgrades. The best way to illustrate the point is with an example.

The Rodgers purchased a home in 1990. Their insurance agent sold them a standard homeowners policy with a $300,000 dwelling limit (Coverage A). In 2010, the Rodgers had a house fire. When they received bids to repair the damage, they found out that the building codes had changed significantly since 1990. In their case, this meant upgrading their concrete block foundation to a poured cement slab, buying an energy efficient HVAC system, and installing a fire sprinkler system.

With all of these increased costs, the Rodgers very quickly found themselves over their $330,000 policy limits ($300,000 Coverage A + $30,000 standard 10% ordinance and law coverage).

Rebuild Law

Building codes aside, one of the biggest surprises homeowners are often met with is the requirement to demolish instead of repair. In many communities, the law requires homeowners to demolish a dwelling that is more than 50% damaged. So while the homeowners may have been happy to simple repair, the law requires them to rebuild. Demolition, debris removal, and rebuild costs add up very quickly in this scenario. Homeowners often find themselves with bills that far exceed their homeowners insurance policy limits.

Ordinance and Law Endorsement

The good news is that additional ordinance and law coverage is readily available through an endorsement. (Endorsement is the insurance industry’s fancy and more confusing word for an add on.) Homeowners can get ordinance and law coverage for up to 50% of the Coverage A (dwelling) limit. In the case of the Rodgers discussed above, that would have given them an extra $150,000 (50% of $300,000 Coverage A) to help repair or rebuild, for a total of $450,000.

Adding an ordinance and law endorsement is especially important if you have an older home. Even homes built a few years ago can be effected by quickly changing building laws, but certainly much older homes should have this important extra coverage.

Homeowners Insurance Policy Reviews

The ordinance and law policy endorsement is just one thing homeowners should consider. And while we’ve done our best to keep this article readable, we suspect you’re not exactly on fire to spend another four hours doing additional research. The best way to make sure your policy is in good order is to call a trusted independent insurance agent. We offer free policy reviews so call or message us before you get busy doing something else!